Türkiye’deki girişimlerin %99.8’i küçük ve orta ölçekli işletmeler olup diğer işletmelere oranla rekabette güçlenmek için e-dönüşüm süreçlerini hızlandırmaktadırlar.

In order to reduce their operational burden, they also prevent paper waste by not dealing with processes such as archiving and printing invoices.

E-Archive Invoice Before explaining, we need to answer the question of What is E-Archive?

[lwptoc]

What is E-Archive

It covers the preservation, electronic transfer and electronic reporting of invoices issued in accordance with the rules and standards determined by the Revenue Administration.. e-Archive is a system developed for the secure transportation of invoices prepared with the system between the sender and the recipient.. E-Archive The obligation to be an e-Invoice user, which is the first necessary condition to be a user, is clearly stated in accordance with the provisions of Tax Procedure Law VUK 509.

What is an E-Archive Invoice?

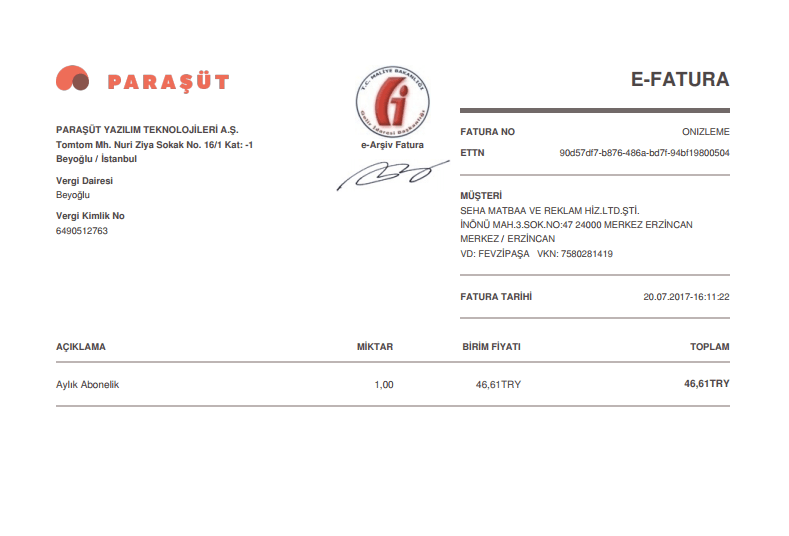

This system will become mandatory as of 2020; It is a form of application that allows the invoices, which must be issued, preserved and submitted in paper form in accordance with the Tax Procedure Law, to be issued electronically in accordance with the criteria specified in the General Communiqué on Tax Procedure Law No. 433 and to be issued electronically and the second copy to be preserved and submitted electronically.

Taxpayers wishing to be included in this application are required to be registered to the e-Invoice application introduced by the General Communiqué on Tax Procedure Law No. 397. All invoices other than invoices created for taxpayers registered to the e-Invoice Application in e-Archive Invoice are called e-Archive Invoice.

In the e-Archive Invoice application, unlike the e-Invoice application, the invoices created are transmitted to the recipient via the RA.

E-Archive Invoice Requirements

- Taxpayers who benefit from the e-Archive Invoice application are obliged to keep the e-Archive Reports and second copy electronic documents they have created in relation to each other, within the time stipulated by tax laws and other legal regulations for paper copies, and to submit them when requested.

- Taxpayers who benefit from the E-Archive Invoice application cannot issue invoices with delivery note

- In the documents prepared within the framework of the e-Archive Invoice application, except for the regulations introduced by the Communiqué No. 433, it must be created in accordance with the time and procedures and principles specified in other tax laws and related regulations, primarily the Tax Procedure Law.

- The e-Archive report content should include the title information of the invoices and the invoices canceled during the period.

- e-Archive Invoices can be transferred electronically or delivered in paper form under appropriate conditions.

As this App is a new requirement, you may have heard or read incomplete or incorrect information about it. The most up-to-date information gurmewoo.com You can access it on the website.

Obligation to be an E-Archive Invoice User

Businesses and enterprises that sell goods and services over the internet and have a gross sales turnover of TL 5 million or more in 2015 and subsequent accounting periods are obliged to use e-Archive Application. The companies in question must complete their actual transition preparations and applications until the beginning of the accounting period following the time when the income or corporate tax return will be submitted depending on the relevant accounting period within the framework of the procedures and principles clearly stated in the General Communiqué of the Tax Procedure Law No. 433 and switch to the e-Archive Application.

E-Archive Invoice Differences Between E-Invoice and E-Invoice

First of all, we will try to fully understand what E-Invoice is and try to write the most striking and easiest version among them. Paper printing and its derivatives do not have any legal value, RA acts as an intermediary, its format is mandatory and the use of financial seal is essential, private integrator or RA is used and its use is mandatory under certain conditions.

If we come to e-archive, the situation is a little different here; It is printed as an electronic document, it is obligatory to report to the RA and free format is used. It must be approved and stored with financial seal and time stamp. Special integrator or own information system is used. Its use is optional except for those who sell over the internet.

Advantages of E-Archive Invoice

Companies that benefit from the E-Archive invoice can create all their invoices electronically and store them electronically throughout the legal period.

Taxpayers who benefit from the e-Archive invoice have the opportunity to deliver their invoices to the recipient electronically under favorable conditions, as well as in paper form.

Companies that switch to e-Archive invoice application can also minimize time, labor, correction, sorting and archiving costs.

Applying a stamp and signature on the invoice paper prepared in the e-Archive invoice, issuing the invoice at the time of delivery of the goods and writing the phrase "It replaces the waybill." on it.